2024 State of the Foodservice Industry

As the industry normalizes, expect moderated sales growth, tamed inflation and a more stable job market.

Following a bumpy road of pandemic closings and restrictions, reopenings and variant surges, the past year brought relative calm. “2023 has been the most normal year for the restaurant industry since 2019,” says Hudson Riehle, senior vice president of research for the National Restaurant Association.

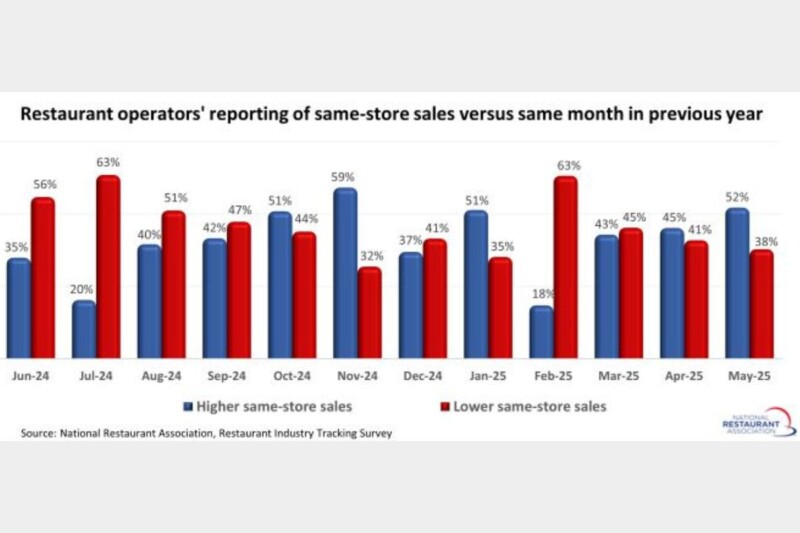

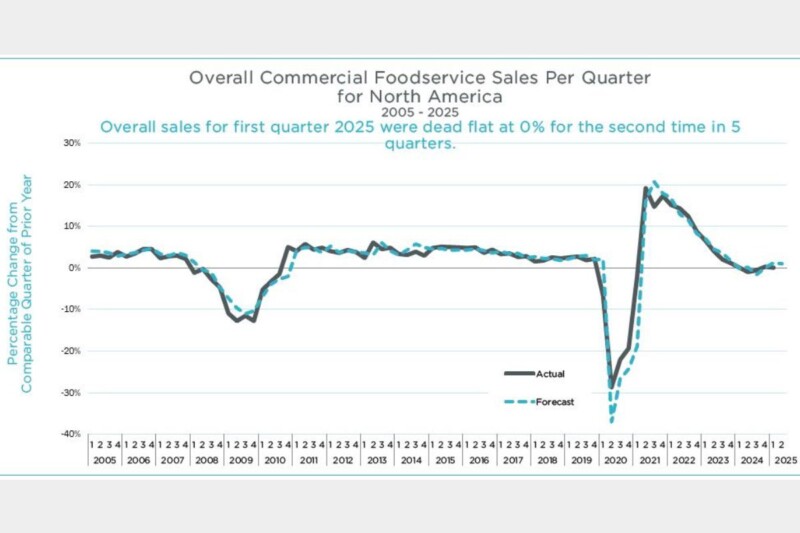

Despite fears of a recession, the economy held up and consumer spending remained strong for foodservice. Sales were even “a little better than expected,” says Victor Fernandez, vice president of insights for Black Box Intelligence, which tracks restaurant market and workforce data intelligence. “We were expecting a slowdown in terms of sales and traffic for the industry this year,” he says. As predicted, sales softened in the second and third quarters, but they exceeded his expectations. “What’s surprising this year is how resilient consumers have been in terms of their spending,” despite an inflationary market and rising interest rates, he notes.

Foodservice analytics firm Technomic projects that the year will finish out with a 6.8% increase in foodservice sales—much of that due to price inflation. Real sales growth, adjusted for inflation, should clock in at 0.3%. “Consumer traffic has essentially started to flatten out,” notes David Henkes, Technomic’s senior principal.

“The consumer continues to hold restaurant spend in a preferred and in many cases, essential category.” —Hudson Riehle, National Restaurant Association

“Going forward, our expectation is that things are going to continue to be soft,” Henkes says. Technomic predicts a 5.6% nominal increase in sales in 2024. “While the value of the industry is not declining, it’s going to grow at a slower rate.” However, with inflation easing, real growth may be higher in 2024, about 2%.

Riehle also expects moderating growth in 2024. Macroeconomic indicators—including the GDP, employment levels and income levels—all point to growth, albeit slower than 2023’s. “It will certainly be another positive year overall,” Riehle notes. “The consumer continues to hold restaurant spend in a preferred and in many cases, essential category.”

HEALING FROM THE PANDEMIC

Three major problems plagued the industry in 2021 and 2022: supply chain issues, rising food costs and staffing shortages. Supply chain issues came under control in 2023, but the industry continued to grapple with inflation and labor concerns. Those two areas appear to be stabilizing, however.

LABOR CHALLENGES. With the supply chain humming along in 2023 and consumers eager for foodservice, a labor shortage was the limiting factor for sales, says Ann Golladay, senior director of publications for food and beverage analytics firm Datassential. “Often operators are trying to get traffic in the door,” she says. “But now they couldn’t get food in front of potential customers, because of that labor piece. It was a real barrier.”

Labor pains eased some later in the year, and will continue on that track in 2024, Golladay predicts. “Wages have improved, so that’s helping bring folks back into foodservice,” she says. Savvy operators are looking at incentives beyond the paycheck, such as employee wellbeing benefits, she notes.

In October 2021, 63% of restaurant operators reported that recruiting was their No. 1 challenge; that number dropped to 49% a year later, and 29% in October 2023, according to the National Restaurant Association. Long before the pandemic, staffing was a perennial challenge, and that’s not changing anytime soon. “But it’s better than it was during the depths of the pandemic,” says Riehle.

Another positive sign: The industry’s turnover rate has fallen from 2022’s historic highs. “But it continues to be much higher than it was back in 2019,” Fernandez says. With fewer vacancies throughout the industry, foodservice wages have stabilized in recent months, according to Black Box Intelligence data. “Without the explosive growth in wages that we’ve seen in recent years, there’s less of an incentive for people to jump ship,” he notes.

With labor still in demand, some operators are turning to technology. Kiosks and tablets continue to gain popularity for orders and payments. 2023 also brought innovations like Chipotle’s intelligent digital makeline, which automatically builds taco and bowls. The National Restaurant Association’s 2023 Kitchen Innovations Award recipients included several smart labor-saving solutions—from a robotic fry cook to a barista-style coffee machine that crafts up to 200 custom drinks. “The technology is getting great, and there are some really cool examples, but we’re a long way from having a fully automated restaurant industry,” says Henkes, noting that employees are often redeployed to oversee and assist the technology. (See “6 Smart AI Solutions” below.)

FOOD COSTS. With food costs on the rise throughout the pandemic, foodservice operators struggled to maintain their margins. Inflation hit a 40-year high in 2022, forcing operators to hike prices. The price for “food away from home” jumped 7.7% in 2022, and is expected to close out 2023 with an additional 7.1% increase, according to the USDA Economic Research Service.

The Fed’s aggressive rate hikes over the past two years have tamed inflation, but it is still elevated, with the overall CPI up 3.2% in October from a year earlier, and “food away from home” up 5.4%. “The inflation rate has been a little stickier than we had expected,” Henkes notes, but it’s letting up. Economic indicators point to further declines in 2024. “What’s really come down is the PPI, the producer price index, which is sort of the supply chain inflation,” he explains. October’s PPI for foods dropped to -2.3%, down from a high of 16.3% in April 2022.

Given inflation, consumers are looking for good values. QSRs did better than expected this past year, Golladay says. “Consumers leaned on QSRs pretty heavily through COVID, so we thought, as we got back out into the world that QSRs would keep moving forward, but not quite as rapidly.” The segment held its ground, thanks to value offerings, menu innovations and clever celebrity partnerships.

Value doesn’t necessarily mean rock bottom prices and limited service. “Excellence in execution becomes even more critical in a high inflationary environment,” Fernandez says. “People are aware of everything being so much more expensive,” he says. “They’re OK with that. The mindset shifts to, ‘Is this worth it?’ We’ve seen in our data, time and again, that if the guest sentiment for food is high, if the service sentiment is high, if the restaurant is clean … if the order is accurate, if the portion looks right to them, … then the value sentiment ends up being high.”

For 2024 perspectives from operators including Balance Pan-Asian Grille, First Watch and Walk-On’s Sports Bistreaux, click here.

THE NEW WAY

Some consumer behaviors adopted out of necessity during the pandemic appear to be here to stay, including increases in online/app ordering and off-premise traffic. In February 2020, 61% of restaurant traffic was off-premise. That number spiked to nearly 90% during the height of the pandemic, and has now settled at 74%, according to the National Restaurant Association. Taking a closer look, quick-service delivery growth has slowed in the past year, as consumers have become more cost-conscious, according to Black Box Intelligence data.

Drive-thru appears to be the big winner in off-premise dining, with an 11-percentage point gain from February 2020 to September 2023, from 26% share of traffic to 37%, according to the National Restaurant Association. So, it’s no surprise that operators have been investing heavily in their drive-thrus, building double or triple lanes—including lanes for expedited app-order pickups—and using AI chatbots to take orders.

Streamlined menus, a reduction in SKUs and improved kitchen efficiencies all also continue to be popular post-pandemic as operators work to keep their businesses competitive. Back-of-house investments are paramount in this new operating environment, says Riehle, pointing to the importance of multifunctional equipment that offers flexibility and technology that improves efficiency by, say, helping operators better sequence orders. “In an era of rapidly escalating costs,” Riehle says, “the investment in the improvements in the back of the house are critical to the viability of these organizations.”

6 SMART AI SOLUTIONS

2023 brought a proliferation of AI technologies to many industries, and foodservice is no exception. Expect to see a wave of new and updated AI solutions in 2024. “In the long term, AI will revolutionize many aspects of the food industry,” predicts a recent Datassential report.

Here are six ways that operators are experimenting with AI:

• Drive-thrus: Wendy’s, Hardee’s and Popeyes are among the restaurants testing AI chatbots to take customer orders. Expect to see multilingual chatbots that let customers order in their preferred language, says David Henkes of Technomic.

• Recipe development and menu design: Can AI match the creativity and culinary expertise of chefs? Only 4% of operators have experimented with using AI for recipe development and menu design—among them Dallas-based Velvet Taco, which grabbed headlines last summer with its ChatGPTaco. Over half of operators (51%) say they would be interested in using AI for this purpose in the future, according to a 2023 survey by Datassential.

• Employee scheduling: By tapping into historical sales data and factoring in the impact of promotions, holidays, the weather, and world and local events, AI can forecast labor needs. The goal is to minimize the cost of overscheduling and the inefficiencies of underscheduling.

• Inventory management: AI also can project inventory needs, reducing overage that leads to costly food waste. According to Datassential, 6% of operators have used AI for inventory management, and 63% would be interested in the future.

• Guest feedback: Understanding big data can become a small task with AI. The latest solutions review, analyze and summarize a plethora of consumer feedback. AI also can generate responses to customer comments on social media and on review forums like Yelp and Google.

• Loyalty programs: AI can analyze past purchases and develop personalized discounts, encouraging repeat business. Says Ann Golladay of Datassential, “Consumers are open to AI solutions like this that add value.”

JOIN US AT MUFES FOR AN INDUSTRY PREVIEW

David Henkes of Technomic will share the latest industry projections and offer his insights for 2024 at FER’s Multiunit Foodservice Equipment Symposium, Jan. 29-31 in Fort Lauderdale, Fla. Henkes will tap into Technomic’s extensive industry data to discuss consumer behaviors, drivers for growth and opportunities to keep on your radar.

David Henkes of Technomic will share the latest industry projections and offer his insights for 2024 at FER’s Multiunit Foodservice Equipment Symposium, Jan. 29-31 in Fort Lauderdale, Fla. Henkes will tap into Technomic’s extensive industry data to discuss consumer behaviors, drivers for growth and opportunities to keep on your radar.

MUFES is a one-of-a-kind event for foodservice equipment and supplies decision-makers from multiunit restaurant brands and noncommercial facilities. Register at fermag.com/mufes.

RELATED CONTENT

- Advertisement -

- Advertisement -

- Advertisement -

TRENDING NOW

- Advertisement -

- Advertisement -

- Advertisement -