2026 State of the Foodservice Industry

Tested but resilient, operators look for more stability in 2026 to help reverse traffic declines.

Even for a year that started with a lot of open questions, 2025 has dwelled in uncertainty in a way that few could have predicted 12 months ago.

To what extent would the second Trump administration execute on its campaign tough talk on tariffs and immigration? (To great extent, in fact.) When would the Federal Reserve start lowering interest rates? (Not until September.) How well would the labor market hold up given these open questions? (Reasonably well, but softening notably in the second half of the year.)

The uncertainty that hung over the start of 2025 weighed on U.S. consumers all year. Tariff headlines changing by the week and news of layoffs at some of America’s big-name employers—Amazon, Microsoft, UPS and Target among them—created a skittishness among consumers, and foodservice operators felt the effects, says David Henkes, a senior principal within Chicago-based Technomic’s advisory group.

The persistent unpredictability “started to affect their willingness to spend much more than we would have expected,” Henkes says. Traffic for many restaurants across dining segments was flat to down in 2025, while sales grew modestly, driven largely by pricing.

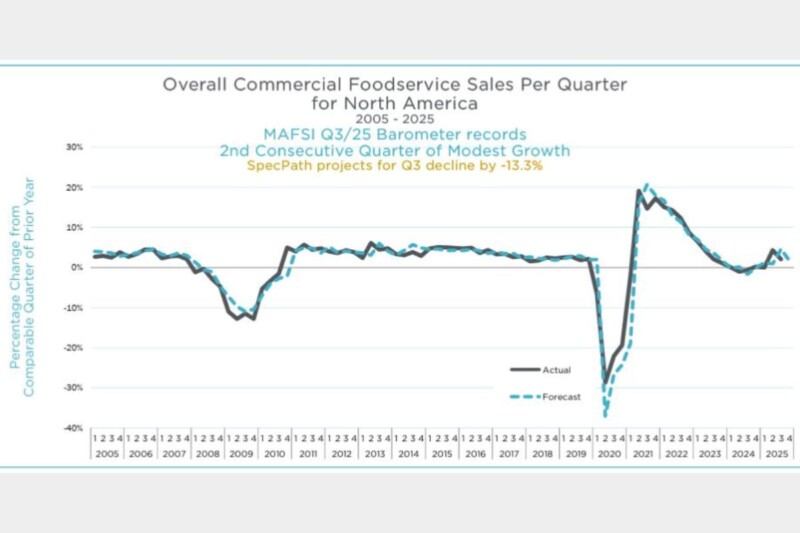

In September, sales at eating and drinking establishments were up 6.7% year over year, while inflation-adjusted growth stood at 2.9%, the National Restaurant Association reported in late November. In October, the association saw 48% of operators reporting rising sales year over year, while 35% saw sales decline. October marked the ninth consecutive month of declining traffic, notes the association. Overall, Technomic projects that 2025 will finish out with a 3.4% increase in foodservice sales. Real sales growth, adjusted for inflation, should come in at -0.4%. Technomic predicts a 4.6% nominal increase in sales in 2026. Real growth may be higher in 2026, about 1.1%.

“The mood is still, I would say, that we’re in a fairly perilous situation,” Henkes says. Indeed, the not-for-profit The Conference Board reported in late November that consumer confidence had fallen to a seven-month low, with consumers downbeat in their outlook for 2026.

“Mid-2026 expectations for labor market conditions remained decidedly negative,” wrote The Conference Board Chief Economist Dana Peterson, “and expectations for increased household incomes shrunk dramatically.”

The silver lining, according to Chad Moutray, senior vice president for industry research and knowledge and chief economist at the National Restaurant Association, is that consumers still are eager to visit restaurants as their budgets allow.

“People do prioritize going out,” Moutray says. “They might currently be going out less than they once did, but at some point you want to have that different experience, eat something different, celebrate something—people still want to go out to eat, and (restaurants) are a good value.”

The Conference Board’s November consumer survey lists restaurants/bars as one of the top five categories for planned spending on services in the next six months. “In general, spending trends among consumers this year have increasingly moved towards cheap thrills and necessary services and away from expensive and highly discretionary activities,” The Conference Board notes.

“Cheap thrills” in the context of foodservice can look like on-the-go indulgences and novel, TikTok- or Instagram-ready treats—think boba teas, dirty sodas or Dubai-chocolate anything.

“Even a $5, $6, $7 beverage is still much more of an affordable indulgence than a $25, $30 fast-casual meal or an $80 steak meal,” Henkes says. “There’s still a place for those,” he adds, “but it’s a lot easier for a consumer, if they’re cutting back, to justify the purchase by saying, ‘This is just a snack,’ or maybe it’s replacing a meal.”

For 2026 perspectives from operators including Teryaki Madness, MilkShake Factory, SPB Hospitality and several more, click here.

BETTING BIG ON BEVERAGES

Consumers’ strong appetite for small indulgences—the “treat yourself” mentality—has been a bright spot in an otherwise challenging environment for limited-service operators.

“Especially in fast food, you’ve got a lot of beverage innovation that is targeting the millennial/Gen Z consumer, and so we remain very bullish (on nonalcoholic beverages),” Henkes says. “Nonalcoholic beverage is really the innovation battleground.”

He pointed to the likes of Arkansas-based 7 Brew, which specializes in not only customizable coffee drinks but also a range of energy drinks and sodas. Eight years after its founding, 7 Brew is one of the fastest-growing chains in the country, with more than 550 drive-thru stands now operating across the country.

Tempe, Ariz.-based Dutch Bros, which Henkes mentioned as another mover in the beverage world, also is expanding nationally with its lineup of sweet and seasonal coffee treats as well as offerings like the Poppin’ Boba Fire Lizard Rebel energy drink.

Chick-fil-A in September announced a drive-thru and dine-in beverage concept, Daybright, from its Red Wagon Ventures subsidiary that would feature coffee drinks, carbonated fruit-flavored drinks, juices and more; the first Daybright unit opened outside Atlanta in the fall.

And while Chicago-based McDonald’s shuttered its CosMc’s concept in 2025, the company is taking its learnings from the beverage-focused operation and trying out a variety of new drinks in select stores. A range of cold beverages in “fan-fueled flavors,” the company said in July, will roll out and scale up following their trial runs.

It’s not only in the limited-service space where beverage innovation is capturing consumers’ attention. Mocktails continue to gain traction at independent operations and chains alike as consumers look to moderate their alcohol consumption. Texas Roadhouse leaned into mocktails in 2025 with options such as a Strawberry Cucumber Fizz and Sparkling Berry Bliss.

Momentum within the beverage space has implications on the equipment and design side, too, of course. Automated beverage machines were inescapable at the National Restaurant Association Show in Chicago last spring, with new offerings emphasizing all-in-one control (from dispensing to lidding a beverage) and beverage customization flexibility. Smart sensors and IoT connectivity on some machines also can help detect emerging operational issues early, helping operators avoid downtime. Self-cleaning and eco-friendly/auto-off options can allow for more-efficient labor and energy use, too.

Alcohol Use Falls

In July, the share of American adults who say they drink alcohol fell to 54%—a 90-year low, according to polling firm Gallup. Among those who do drink, 40% said they hadn’t consumed an alcoholic beverage in the past week—the highest share since 2000. Also, for the first time, a majority of respondents, 53%, said that even drinking in moderation (one or two drinks per day) is bad for one’s health.

ALL ABOUT THE EXPERIENCE

In such a spending-sensitive time, consumers are looking for high-quality experiences to help justify their away-from-home food and beverage purchases. That may look like seamlessly ordered and accurately prepared beverages to provide a midday caffeine boost, or it could be drinks and appetizers to catch up with friends after work. Either way, for consumers, it’s a momentary escape from daily chaos.

That’s key for operators when it comes to restaurant design and the refreshing of both menus and spaces, says Keenan Marchesi, economist at Chicago-based Datassential.

“Restaurant whimsy emerged as a defining trend in 2025, as operators responded to economic uncertainty by creating playful, joy-filled dining experiences in the era of ‘little treat culture,’” Marchesi says. “This shift toward vibrant colors, carnivalesque decor and whimsical atmospheres marks a clear departure from minimalist aesthetics. With 86% of consumers interested in visiting these playful environments for celebrations and special occasions, restaurants are leaning into maximalism and social media-worthy concepts that blend nostalgia with modern twists.”

Technomic’s Henkes echoes Marchesi’s comments. “I think there’s been a renewed focus on the experiential,” Henkes says. And whether that looks like a secluded-from-the-outside-world back patio or a lively bar area, it’s about creating “something that the guest can’t get at home,” he says.

It’s worth noting, too, that higher-income consumers who are snapping up unique dining experiences—prix-fixe winemaker dinners and private igloos with hot-cocoa cocktails, anyone?—are helping prop up foodservice sales overall. In an increasingly pronounced K-shaped economy, “you certainly see wealthier individuals continuing to prop up the industry,” the National Restaurant Association’s Moutray notes. “Many fine-dining establishments are not having a lot of issues right now.”

Kitchen Clean-Out

To help manage costs and address continued labor challenges, more foodservice operators are looking to streamline their kitchens, Datassential’s Keenan Marchesi says. Seventeen percent of operators report having removed back-of-house equipment since 2023, he says, “with deli meat slicers (24%) and floor mixers (20%) leading the way.” Moderate removals were seen for microwave ovens, tilt skillets and food processors, at 14% each. These moves, says Marchesi, point to menu simplification and a growing reliance on preprepared ingredients. In contrast, “essential equipment like walk-in coolers and high-speed ovens remain largely untouched,” he says, “underscoring their critical role in maintaining operational efficiency and meeting consumer expectations for fresh, quick service.”

SEEKING STEADINESS

Heading into 2026, there is reason to carry some of that cautious optimism that the industry donned at the outset of 2025, Moutray suggests.

Interest rates are likely to continue to fall in the new year, and with the administration’s push on select tax incentives, “there is going to be some stimulus in the economy,” Moutray says, “so hopefully that brings some people off the sidelines.”

Getting the proverbial “butts in seats” to reverse persistent traffic declines will remain a top priority for foodservice operators, and finding the sweet spot of offering affordability and also a craveable experience—justifiability, in effect—will be vital in helping operators get more folks through the door (or the drive-thru).

It’s a challenging and tenuous environment, to be sure, but “we are a really resilient economy,” Moutray notes. “We have not had a recession despite the fact that we’ve been talking about the possibility of one for the past three years or more.” And with the foodservice industry’s

hallmark abilities to both adapt and innovate, operators will welcome in consumers eager to dine out as soon as they feel a little better positioned to do so.

Worth Watching

What is Technomic’s David Henkes watching in the new year?

“There’s a slide we put together with three lines on a graph: menu price inflation, general industry inflation and wage increases,” he says. “What has happened over the past three to five years is that wages have caught up with general inflation for the most part, (and) the broader wages and inflation are now growing at about the same rate, which means that maybe consumers feel a little bit better about their overall situation.” But importantly for the foodservice industry, he adds, “the gap that hasn’t closed is the gap between menu price inflation and wages, and so this affordability crisis really is driven by the fact that even though people’s wages are growing, they’re not growing as fast as menu prices continue to grow.

“The big thing that we’re keeping an eye on,” he continues, “is does this gap start to close at all? We don’t really believe that you’re going to see any kind of sustainable growth in the industry unless people’s wages catch up with dine-out prices.” That’s not going to happen overnight or in a matter of a few months, Henkes says, but “hopefully in 2026 that affordability gap starts to close. Consumers need to feel that it’s affordable to dine out again.”

Coming Soon

Chad Moutray of the National Restaurant Association will present at FER’s Multiunit Foodservice Equipment Symposium on Feb. 4 in Clearwater Beach, Fla. To register, click here.

Chad Moutray of the National Restaurant Association will present at FER’s Multiunit Foodservice Equipment Symposium on Feb. 4 in Clearwater Beach, Fla. To register, click here.

ABOUT THE AUTHOR

RELATED CONTENT

- Advertisement -

- Advertisement -

- Advertisement -

TRENDING NOW

- Advertisement -

- Advertisement -

- Advertisement -