Q2 Barometer Seemingly Shows ‘Best-Case Scenario’

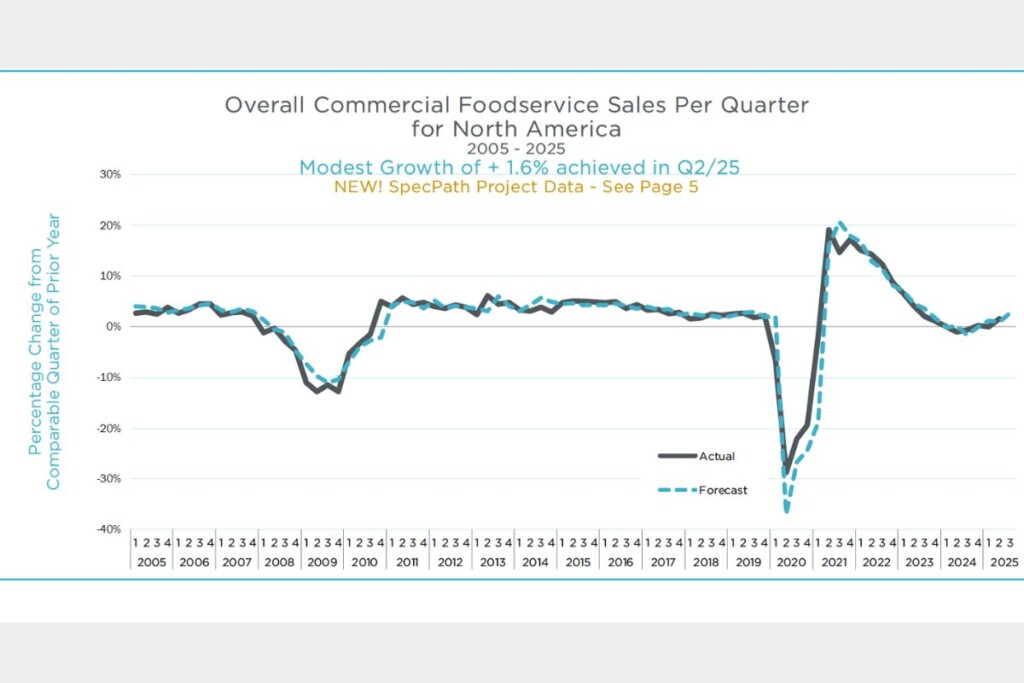

The final numbers surpassed the association's Q1 prediction of 1.0% growth amid ongoing uncertainties.

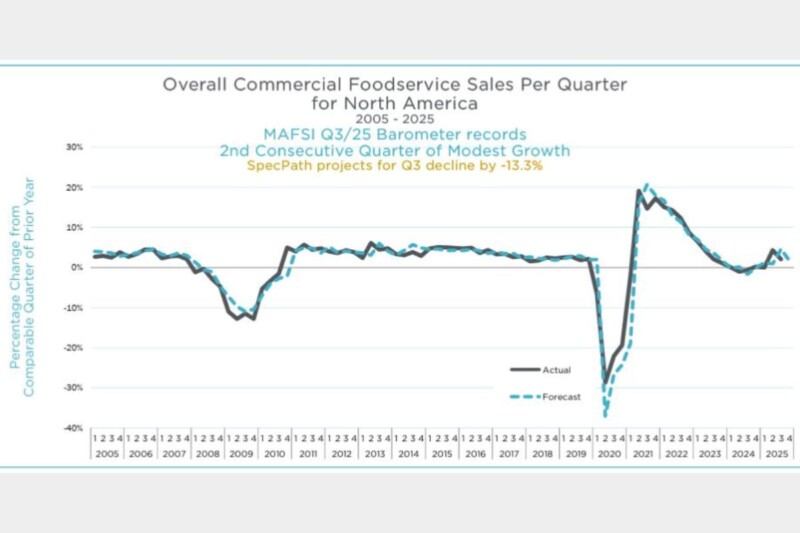

Following a flat reading in Q1, the most recent quarter saw a slight uptick in sales, according to the new MAFSI Barometer.

Q2’s 1.6% increase was the largest gain in 18 months, notes Michael R. Posternak, CEO PBAC and Associates, in his executive summary.

“Sluggish growth, at this point, seems to be the best-case scenario,” Posternak adds. “The temperature of the market can also now be measured by the change in activity in MAFSI’S SpecPath Report which tracked 1,859 projects in Q1 and Q2 2024 versus 1,895 projects in Q1 and Q2 2025 for an increase of 1.9%. … The disruptive effect of tariffs on the foodservice industry has not yet been fully realized and makes forecasting a nearly impossible task.”

Q2 equipment sales were up 1.7%, followed by tabletop and furniture at 1.6%, and supplies trailing at 0.7%.

Regionally, the Northeast led with an overall gain of 2.9%, then the West at 2.7%, the Midwest at 2.0% and the South at 1.1%. Canada, meanwhile, had a -0.6% decline.

For Q3, MAFSI forecasts a year-over-year increase of 2.7%—a number on par with MAFSI’s 2025 Annual Forecast prediction.

RELATED CONTENT

- Advertisement -

- Advertisement -

- Advertisement -

TRENDING NOW

- Advertisement -

- Advertisement -

- Advertisement -