MAFSI Predicts ‘Dynamic and Unprecedented Times Ahead’

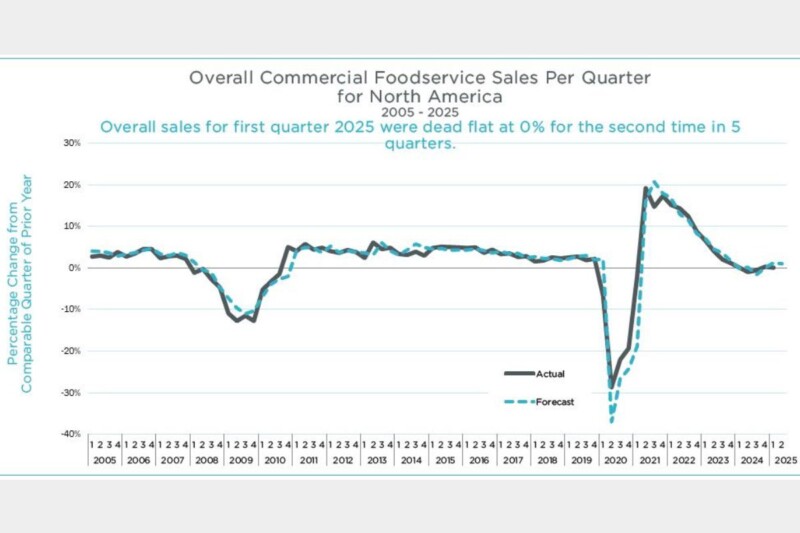

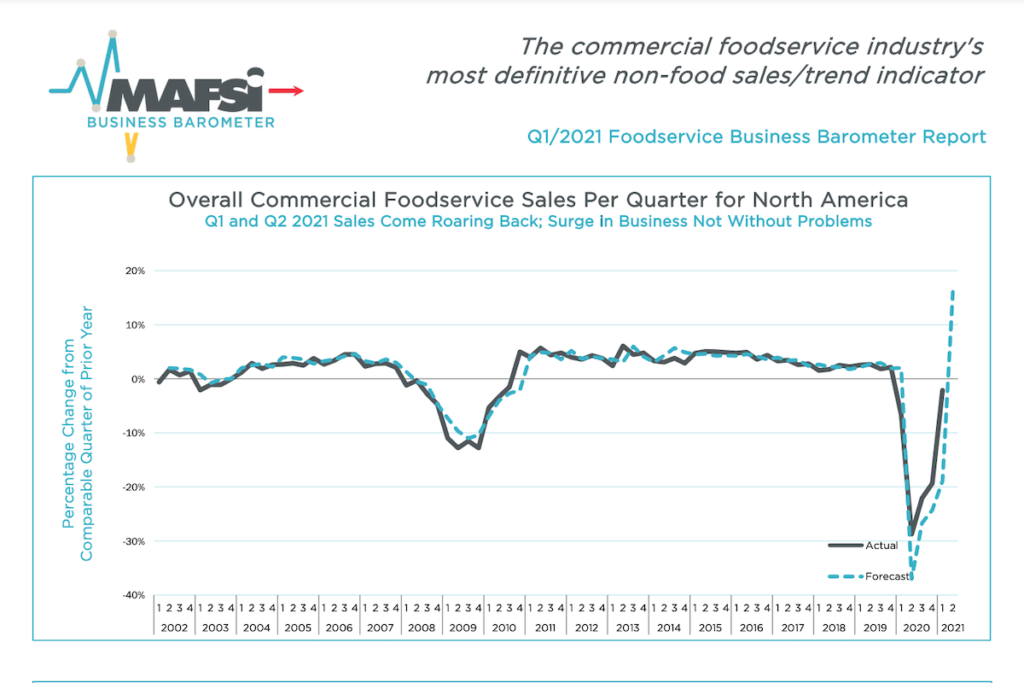

Overall sales for Q1 2021 were down -2.1% compared to Q1 2020—a marked improvement from -19.4% in Q4 2020 and the Q4 forecast of -18.9% in Q1 2021.

MAFSI’s Q1 2021 Business Barometer is out and largely positive, but not without cautionary warnings.

“With the return to normalcy, the recovery is dramatic in its intensity,” MAFSI said, noting that 81% of reps said they are quoting more and 56% are seeing more specs.

Putting a damper on the good news, however, are lingering challenges with supply, labor and wage pressures, raw material shortages, and transportation availability. In turn, manufacturers and their customers are up against price hikes, longer lead times and more.

“Eventually, this surge of business will level off as supply and demand rebalance,” MAFSI predicts. “The population is shifting from California and New York to Texas and Florida, which are long-term trends. Add to this, the activity reported by Clarity M&A LLC at the dealer, rep, and for sure, the manufacturer levels. We are certainly in for some dynamic and unprecedented times ahead.”

Overall sales for Q1 2021 were down -2.1% compared to Q1 2020—a marked improvement from -19.4% in Q4 2020 and the Q4 forecast of -18.9% in Q1 2021.

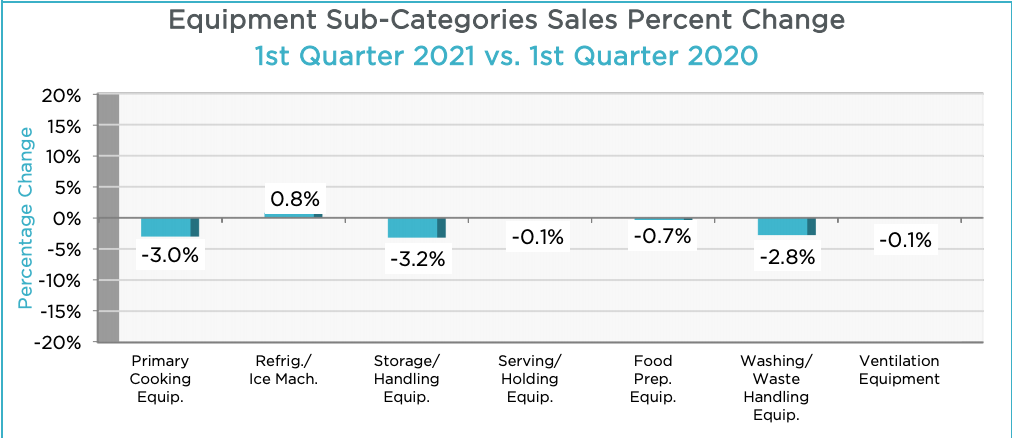

Categorically, tabletop sales took the biggest blow in Q1, with sales down -9.7%, up from -39.5% in Q4. Supply was down -3.9%, equipment down -1.1% and furniture up 0.3%.

The West and Midwest were the only regions with negative overall sales percentages in Q1, at -9.8% and -7.7%, respectively. Looking ahead, for Q2, MAFSI anticipates “huge gains” for all markets, ranging from +14.6% in the South to +21.4% in Canada.

RELATED CONTENT

- Advertisement -

- Advertisement -

- Advertisement -

TRENDING NOW

- Advertisement -

- Advertisement -

- Advertisement -