Steel Shortages, More Constrain Manufacturers’ Operations

NAFEM has long been in the game of advocating on behalf of U.S. foodservice equipment manufacturers, but it’s a whole new playing field right now.

Its members (along with those in many other industries) are up against multiple supply shortages, elevated shipping costs and delays, and tariffs—the latter of which the association has been battling for years.

“Unfortunately, these exacerbated challenges come at a time when NAFEM-member businesses across the country are still recovering from challenges presented by the COVID-19 pandemic,” said Charlie Souhrada, NAFEM’s vice president of regulatory and technical affairs, in a press release. “These interrelated issues are impacting schools, hospitals, military bases, restaurants, hotels and other organizations that rely on commercial foodservice equipment to feed millions every day.”

During an advocacy webinar on April 28, Souhrada and other association representatives offered insight into some of the most prevalent issues reported by its members through a recent survey. NAFEM sent the survey to 400 member companies, 41 of which responded. Data was collected between April 5-16.

Here are some of the survey’s highlights:

- Supply shortages are having the most significant impact on manufacturers, followed by the rising cost of shipping, international shipping delays, Section 301 tariffs on U.S. imports from China and Section 232 tariffs on steel/aluminum, respectively.

- Steel and aluminum supply shortages are the most prevalent (52%), followed by shortages of plastics (42%), and semi-conductor chips (33%). Members also report lesser shortages of polyurethane and foam insulation, lumber, wire and wire harnesses.

- Metal supply issues in particular are having a 100-percent impact on manufacturers’ abilities to control costs. Members said metal supply issues also impacted their company’s ability to grow (73%), compete (64%) and maintain their workforce (46%).

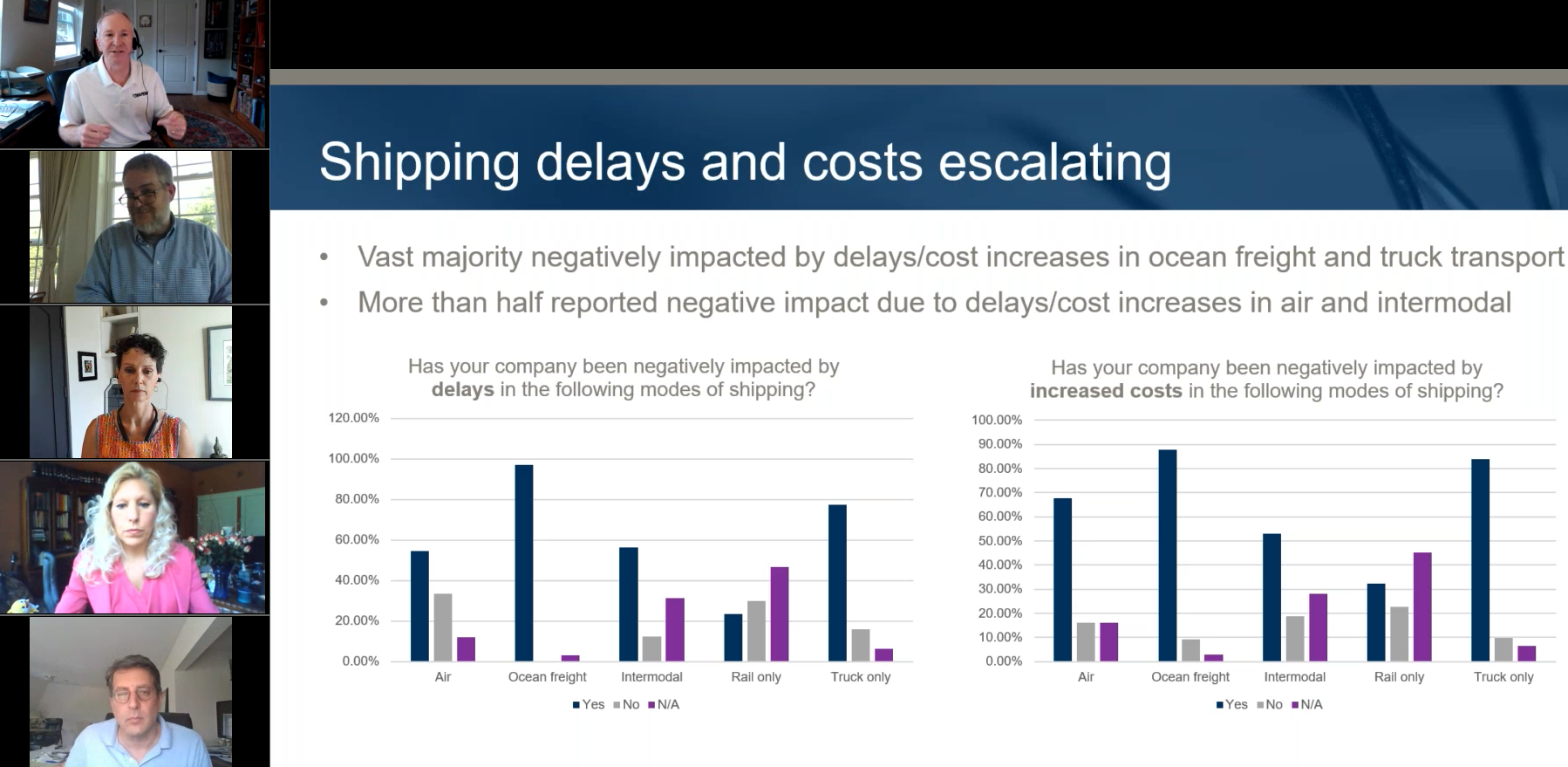

- Ocean freight and truck transport related delays and cost increases alike were overall attributed with having a higher negative impact than the three other modes of shipping: air, intermodal and rail.

NAFEM’s Charlie Souhrada (top left) presents a portion of the association’s recent survey findings during an April 28 webinar.

- Metal sourcing issues caused lead time delays of less than a month among 50% of manufacturers, though Souhrada said he was surprised that impact wasn’t more significant.

- Sixty percent reported experiencing supply issues on imports from China, causing many to seek new vendors, with the majority of those who have made changes forming new vendor relationships in alternate countries.

- Supply issues with imports from China are impacting respondents’ abilities to control costs (100%), grow (64%), compete (62%) and their need for employees (50%).

While the survey offers a snapshot of what the industry is enduring, Souhrada urged members to work with the association when it seeks information, as it only helps further the cause. This data is particularly important, he added, in states such as Illinois, Michigan, Ohio and Pennsylvania—all of which contain many NAFEM members and all of which lost congressional seats as a result of the 2020 Census.

“Politicians recognize economic clout, and it’s difficult for us to gain attention or traction on the issues the industry needs if we can’t illustrate the economic impact on our member companies,” Souhrada said. “So, the next time we ask for these numbers, please help us help you by providing them and help spread the word too to those who haven’t.”

For more on NAFEM’s efforts and how to get involved, visit its advocacy page.

RELATED CONTENT

- Advertisement -

- Advertisement -

- Advertisement -

TRENDING NOW

- Advertisement -

- Advertisement -

- Advertisement -