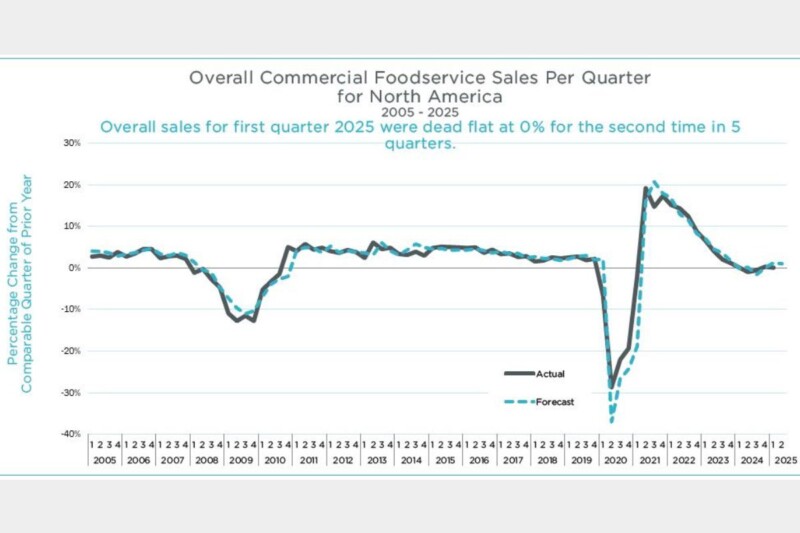

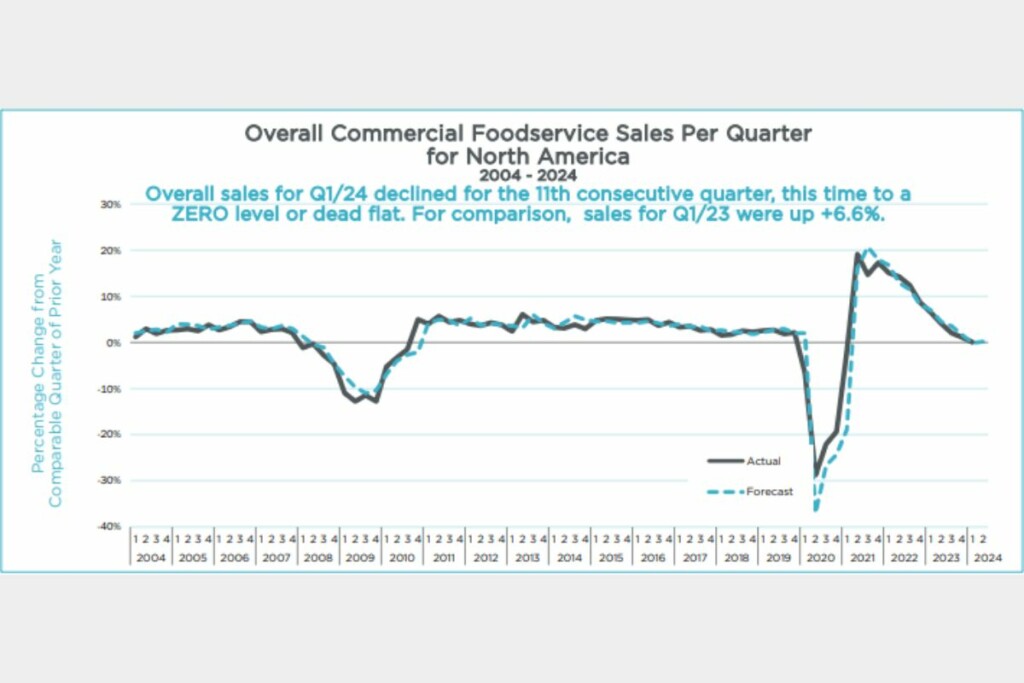

According to MAFSI’s newly released Q1 Business Barometer, sales have now declined for the 11th consecutive quarter, though a second-half rebound might still be possible.

In Q1/24, sales were flat at 0%, a slight slip from the .5% increase MAFSI predicted in its last edition. By comparison, sales were up 6.6% in Q1/23.

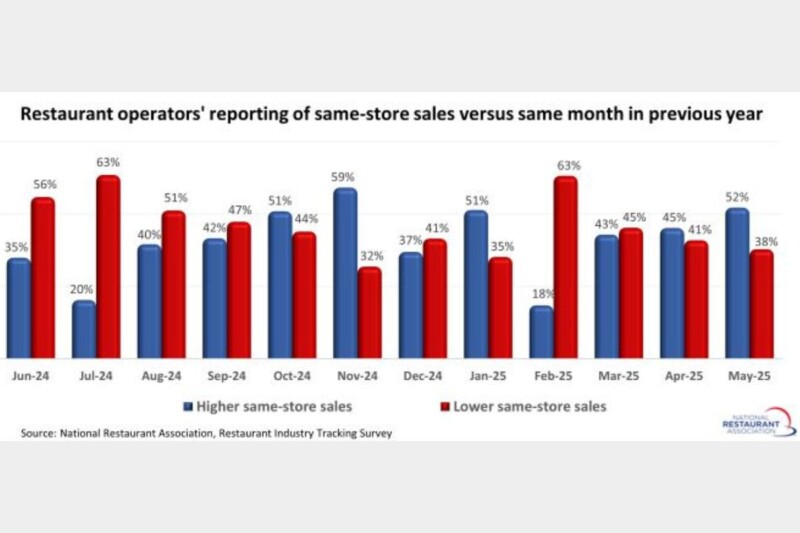

“At zero growth, the MAFSI Business Barometer is ahead, by a few percentage points, of the results that have been released by the public manufacturers and by the restaurant segment in general,” writes Michael R. Posternak, CEO at PBAC and Associates, in the executive summary. “Furthermore, much has been reported in the media and by [the National Restaurant Association] of the impact of higher menu prices caused by food, E & S, and labor inflation and as well by higher interest rates.”

By product category, furniture sales across North America led with a bump of .5%, as compared to Q1/23, followed by a .3% increase in equipment sales; tabletop sales were down -2% and supplies declined -.3%.

Sales were the highest in Canada (2%), followed by the Northeast (1.2%). The West, Midwest and South were in the negative at -1.3%, -.9%, and -.5%, respectively.

Sights on Q2, Beyond

For Q2, MAFSI is forecasting a .1% increase.

“Hope remains for a second-half rebound, although concerns exist that the industry might not have hit bottom yet,” Posternak says.

In Q4, the report predicted an increase of 3.6% for 2024 in full.

RELATED CONTENT

- Advertisement -

- Advertisement -

- Advertisement -

TRENDING NOW

- Advertisement -

- Advertisement -

- Advertisement -