Checking In With 2025’s Top Dealers

Expanding in markets, upgrading technology and training future leaders mark ways dealers work to meet operator needs.

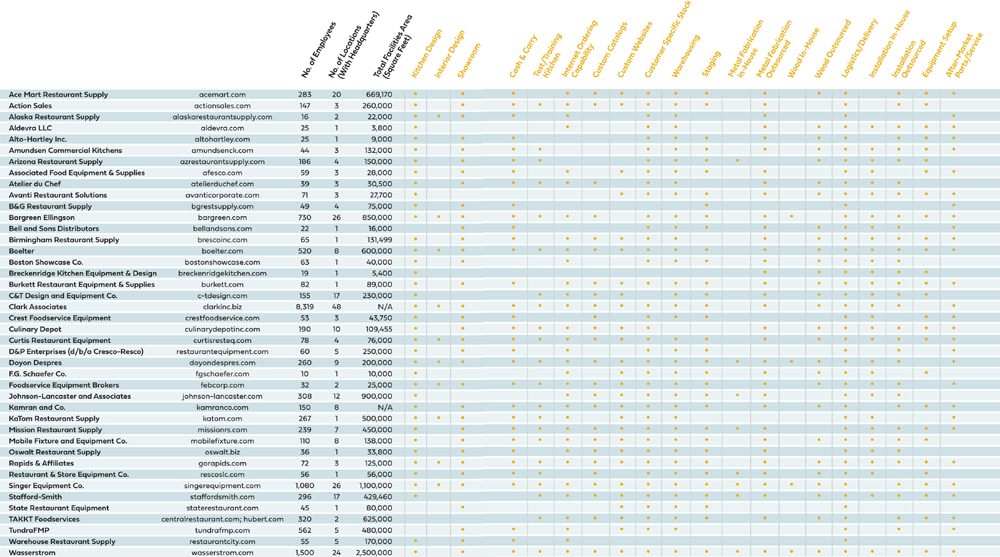

Participating dealers in the FER 2025 Top Dealers Report say 2024 was anywhere from exceptional to a struggle. Sales revenue was down for many. In total, only 21 of 42 reported an increase compared with 36 of 46 dealers (a somewhat different mix) in the 2024 report. Reasons for the drop ranged from economic uncertainty to the incredible pressures on restaurant operators.

Keep in mind sales revenue doesn’t indicate performance; many factors can affect a dealer year to year. Rather, FER collects the data to show scale. It also gathers what services dealers offer. It’s all meant to help operators determine whose capabilities match their needs.

Combined, 2025 participating dealers reported sales of $9.8 billion in 2024, up 3.6% from what those same dealers posted in 2023.

For a snapshot of the dealer community, FER checked in with a handful of dealers to find out what highlights they experienced in 2024, and what challenges and opportunities they see in the coming year. Gaining ground in certain markets, creating in-house efficiencies and building the next generation serve as big-picture priorities. But at press time, in mid-April, the latest tariffs and the impact they would have on prices and the supply chain were front and center.

“I feel like with our industry, whether you import products, like some of us do, or even if you don’t, there’s no getting away from the impacts of what’s feeling like a trade war at the moment,” says Gene Clark, CEO of Clark Associates, based in Lancaster, Pa. “This is going to touch our industry, whether you like it or not.”

Gene Clark says Clark Associates added 1.6 million square feet of warehouse space in the past couple years.

Scaling Up

Several dealers expanded their footprints via acquisitions or store openings in 2024. M&A activity included Singer Equipment Co. acquiring Hotel & Restaurant Supply, and Johnson-Lancaster and Associates acquiring SoCal RDG/IFE Group. Clark Associates opened its first Florida location of The Restaurant Store in Orlando.

Fred Singer of Singer Equipment points to how the dealership continues to grow its footprint; recent acquisitions expanded its reach in the southeast and across New York.

“2024 was an exceptional year; it was the best year in the history of our company,” says Fred Singer, president and CEO of Singer Equipment, based in Elverson, Pa. Singer attributes the company’s success (a more than 28% increase in year-over-year revenue) to the acquisition; to large, complex customers who outperformed; and to its corporate culture and values, which include maintaining strong vendor relationships.

Partnering with Hotel & Restaurant Supply, now named Singer H&R, helped Singer Equipment expand its presence in the southeast. In the April 2024 announcement, Singer H&R listed locations throughout Mississippi, Alabama, Tennessee and Louisiana. Singer also says it gained a large amount of in-house installers and an in-house fabrication shop with the deal. Most recently, in April 2025, Singer Equipment announced it expanded its reach across New York by acquiring Joseph Flihan Co.

Kristen Horn, COO of Johnson-Lancaster, based in Clearwater, Fla., says acquiring SoCal RDG has given the dealership, which already had representation on the West Coast, a stronger grip on the region.

“It’s great for us to be able to better serve our customers and have another hands-on approach out on the West Coast,” Horn says. “We found that a lot of our clients we’re working with now have a presence in the region.” She says it’s a seamless marriage, as Johnson-Lancaster offers SoCal RDG its size, purchasing power and more benefits. Another highlight in 2024, she adds, was Johnson-Lancaster’s completion of its largest-ever project, valued at more than $55 million, for a confidential theme park and hotels.

“We had equipment and smallwares on that package and we’ve been working on it for a few years now,” Horn says. “It was very exciting that we had our biggest push in 2024.”

So far in 2025, Johnson-Lancaster has already gained more ground, again out west, this time with the launch of Las Vegas RDG, serving the Las Vegas restaurant and hotel community.

Clark Associates will add two more Florida locations of The Restaurant Store in 2025. One store will open in Davie and the other in Jacksonville. In reference to the Orlando store, Clark says in his 2025 CEO letter, “With over 865 miles between this new store and our other northeast locations, we were excited to not only expand our footprint down the coast but to also add new products in store to cater to the region’s distinct cooking style, flavors and ingredients.”

Efficiency Upgrades

Nearly every dealer FER spoke with spent time in 2024 creating a more efficient operation, such as leaning into technology or streamlining purchasing processes, to prepare for the future.

“KaTom’s big thing is, we want to meet our customers where they are and we want our technology to be advanced enough that it’s supportive and cumulative for all their needs.”

—Patricia Bible, KaTom Restaurant Supply

KaTom Restaurant Supply, headquartered in Kodak, Tenn., spent 2024 investing in its data stack, says Patricia Bible.

Take KaTom Restaurant Supply of Kodak, Tenn., for example. Patricia Bible, founder, president and CEO, says 2024 was in some ways a challenge, especially with so much political uncertainty. But one highlight, she says, was how the dealership stopped, looked internally at its processes and platforms, and reevaluated every division to figure out how to be more proficient and effective.

“We have spent a lot of time on our data stack,” says Bible, explaining that, instead of a bunch of individual systems (think CRM and ERP), everything now flows together. The improvements also allow the dealership to lean into its own proprietary artificial intelligence platform, which will be used for e-commerce supply chain and analytics to further its growth.

“KaTom’s big thing is, we want to meet our customers where they are,” Bible says, “and we want our technology to be advanced enough that it’s supportive and cumulative for all their needs.”

Other examples of technology upgrades dealers made include the rollout of an AI-enabled CRM to create efficiency for sales teams, the use of AI email assistants to allow staffers to focus more on serving clients and the use of AI to help an accounts payable department scale invoice processing with company growth. Several dealers also say operators are taking advantage of custom websites now more than ever to ease the product ordering process.

At Mobile Fixture and Equipment Co., CEO Ben Whitlock and the rest of the leadership team, who took ownership of the dealership in 2022, looked at their purchasing processes when searching for efficiencies.

“One of our main objectives in 2024 was to reduce the amount of overall inventory we have, and the only way to do that was to implement a streamlined purchasing department,” says Whitlock. “The department went live at the beginning of this year and we’re off to a great start.”

The Mobile, Ala.-based dealership has eight branches total. It saw sales revenue grow over 19%, one of the bigger increases of any participating dealer, because of some projects that were delayed from 2023, Whitlock says.

Streamlining purchasing processes and investing in talent are a few priorities at Mobile Fixture and Equipment Co., says Ben Whitlock. The Mobile, Ala.-based dealership, complete with eight branches, saw one of the bigger increases in 2024 sales revenue as a result of some projects that were delayed in 2023.

Training the Next Generation

To best serve operators, dealers continue to develop the next wave of talent, and that looks a little different across the community. Bible has created a family business, with her daughter Paula Chesworth serving as vice president of e-commerce and son Charley Bible as vice president of business development. In fact, Bible says, Charley oversaw a boom in KaTom’s design-build area in 2024 as a result of working with a few emerging chains.

Whitlock says Mobile Fixture started making a push last year (and will continue this year) to hire younger, sometimes less experienced salespeople and sales assistants versus seasoned professionals from other companies. Now that pandemic-imposed lockdowns are in the past, he says, in-person training opportunities abound.

“We’re investing in younger, less experienced hires by sending them to factories, trainings, NAFEM and NRA,” Whitlock says. “Whatever the opportunity is, we’re taking advantage of it and sending people there. It’s directly translating into much more loyal and longer-term employees.”

Meanwhile, at Singer Equipment, training also is key. “We’re running our first class, called Singer Leadership, and it’s a group of high-potential employees that we get together to develop future leaders in the company for several weeks of training and then monthly meetings,” Singer says. “It’s like a Singer university.”

On the horizon, dealers anticipate more uncertainty, part of which comes from the latest tariffs. Many agree, staying nimble and agile and building deeper bonds with customers and vendors will help them stay ahead.

-Additional reporting by Christine Palmer

2025 Top Dealers, By The Numbers

ABOUT THE RANKINGS

The FER Top Dealers Report is a ranking of dealers (see below for definition) that have provided independent verification of their revenues. (TriMark USA didn’t respond to requests to participate.) It’s not meant to be a comprehensive list, though many dealers capable of serving multiunit operators are listed. M&A activity in 2024 included Singer Equipment Co. acquiring Hotel & Restaurant Supply, Johnson-Lancaster and Associates acquiring SoCal RDG/IFE Group, Kamran and Co. picking up Atlas Restaurant Supply, and Ace Mart Restaurant Supply adding Curtis Restaurant Supply.

Editor’s note: After this story was published, TriMark USA reported its 2024 revenue of $2,271,000,000 and 2023 revenue of $2,375,000,000. The story doesn’t reflect these numbers.

What’s a Dealer?

For the FER Top Dealers Report ranking, FER uses the following criteria: To be ranked, the dealer must independently verify its volume. This is usually done with a signature from a CPA. If more than 50% of a distributor’s sales are from paper, chemicals and other nondurables, FER does not include them. This excludes nearly all broadline distributors and paper distributors that have significant equipment and supplies volume.

Dealers were asked to detail the services they offer. FER asked that they check off on a service only if it’s performed by company employees or in company facilities, unless otherwise noted for fabrication and installation services. Note other offerings from Stafford-Smith include commercial refrigeration and HVAC service and from TundraFMP, the LaunchPad NRO Program (New Restaurant Openings Program).

For the digital magazine version of this chart, click here.

ABOUT THE AUTHOR

RELATED CONTENT

- Advertisement -

- Advertisement -

- Advertisement -

TRENDING NOW

- Advertisement -

- Advertisement -

- Advertisement -