2023 State of the Foodservice Industry

Continued menu price inflation, a changing B&I industry and recession probability top forecasters’ 2023 watchlists.

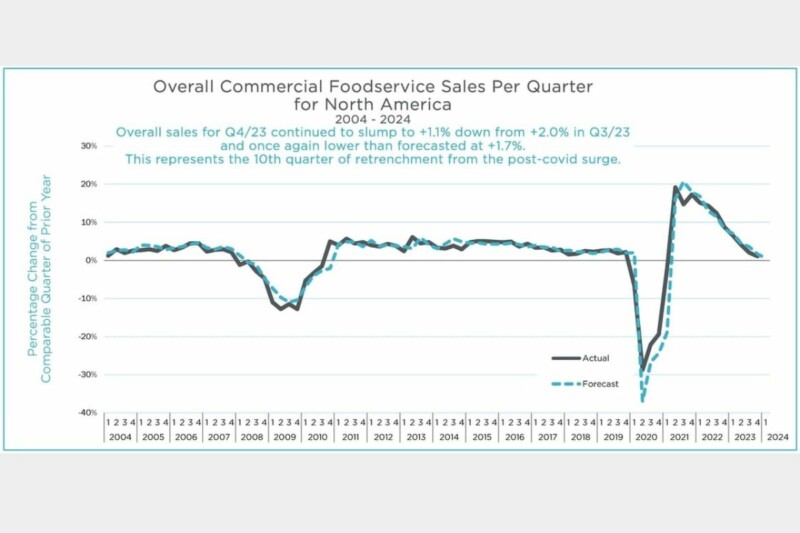

At first glance, 2022 looks like a remarkable bounce-back year for the foodservice industry. The industry is projected to end the year with a 9.9% annual increase in sales dollars, according to industry analytics firm Technomic. But hefty inflation tempered that bounce, taking the air out of real sales. Factoring in menu price increases, the industry is slated to close out 2022 with real growth of 2.6%, Technomic projects. Clearly, still a year of growth, just not near the 6.9% real growth Technomic had originally projected.

“Consumers are still spending as much or more per occasion. … They’re just doing it less often.” —David Henkes, Technomic

“While the industry looks relatively good from a value perspective, if you peel back the onion a little bit, it’s not quite as healthy as it would look just based on the dollar figures,” notes David Henkes, Technomic’s senior principal.

After two years of coping with pandemic woes, the foodservice industry went on to tackle relentless challenges in 2022. The year started with the omicron coronavirus surge, which softened January sales. A triple whammy of labor shortages, supply chain issues and soaring inflation created difficult operating conditions. The war in Ukraine led to global food supply issues that drove wholesale food prices even higher.

Datassential, another analytics firm, reports stronger growth than Technomic, but with a similar pounding from inflation. It projects 13.5% nominal growth, or 5.1% real growth.

Factoring in menu price increases, the industry is slated to close out 2022 with real growth of 2.6%, Technomic projects.

“Perhaps the biggest surprise [in 2022] was how extreme menu price inflation was,” says Hudson Riehle, the National Restaurant Association’s senior vice president of research and knowledge. “We forecast menu price increases around 6%, and it is currently coming in at 7.4%. From both an operator and a consumer perspective, that definitely has and will continue to impact behavior.” Adjusting for menu price increases, eating and drinking place sales declined in three of the last four months that data is available for, according to the association.

The industry didn’t see the traffic growth expected this year, says David Portalatin, food industry advisor for analytics firm NPD Group. “We originally felt that 2022 would see recovery of about 98% of pre-pandemic traffic volume. We’re not going to get there,” says Portalatin, projecting that 2022 will finish 4% behind 2019 traffic.

Henkes says “consumers are still spending as much or more per occasion. … They’re just doing it less often.” Consumers trended toward cutting back through the fall of 2022, and additional pressures on the horizon could mean more cutbacks, he says.

ROAD TO RECOVERY

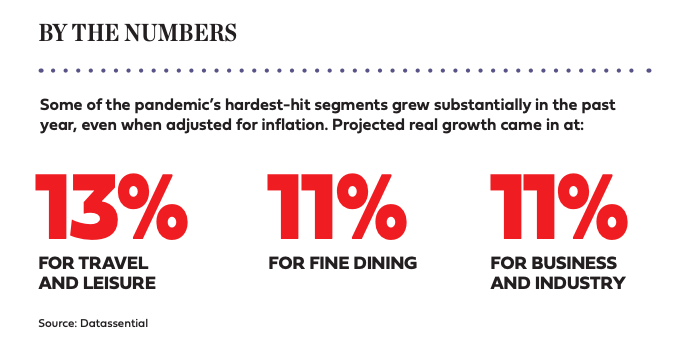

Despite the challenges, the foodservice industry made progress on its road to recovery. Some of the pandemic’s hardest-hit segments grew substantially in the past year, even when adjusted for inflation—13% projected real growth for travel and leisure; and 11% each for fine dining and for business and industry, according to Datassential. With so many people telecommuting, B&I is still below pre-pandemic numbers. “Unfortunately, it’s never going to be the segment it was pre-COVID,” says Ann Golladay, Datassential’s senior director of content.

After taking a pounding during the early stages of the pandemic, breakfast has emerged as a bright spot in the day, with traffic now within 1% of pre-pandemic levels, according to NPD research. “Convenience at breakfast is such an important factor,” says Portalatin.

In particular, traffic has heated up in the gourmet coffee and tea segment, which this August was 15% above levels seen in August 2019. Portalatin notes that gourmet beverages are “a relatively affordable indulgence that consumers can use to treat themselves when they might otherwise not be feeling great about the economy.”

2023 OUTLOOK

The good news is that inflation is expected to slow in 2023, in response to the Federal Reserve’s interest rate hikes. This year it topped 8%; economists project closer to 4% or 5% next year, says Riehle. Of course, next year’s inflation is on top of two historically high years, and that’s creating pressure on operators and consumers.

In an attempt to woo customers, foodservice operators have held their prices low in respect to overall inflation, Golladay says. “Coming out of the pandemic, with the mindset of getting people in the door, many operators were reluctant to raise prices,” she notes. “But we’re definitely going to see [menu] prices going up this year, because operators are taking real hits to their margins.”

The big looming question as we enter 2023 is: Are we headed toward a recession?

After two consecutive quarters of negative gross domestic product during the first half of 2022, the GDP rose 2.6% in the third quarter. Riehle contends that we haven’t dipped into a recession—yet. “When you look at the four major macroeconomic indicators— industrial production, income, employment, and consumer spending—there is moderation, but it’s still substantially positive,” he explains. Many economists project a contraction to begin the second half of 2023, he notes.

“Even with a potential recession, the impact could be relatively minor [on the industry]. Historically, when you look at recessions in the restaurant industry, industry performance is never quite as weak as the overall underlying environment,” says Riehle, noting that consumers view outsourced meal preparation as essential.

The good news is that inflation is expected to slow in 2023, in response to the Federal Reserve’s interest rate hikes.

“A lot of economists are saying it’s not a matter of if [we’re going to have a recession], but when,” says Victor Fernandez, vice president of insights and knowledge for Black Box Intelligence. A contraction of the economy could lead consumers to trade down to less expensive segments within the industry, he notes. “Value offerings will probably resonate with a lot of consumers,” he says.

In general, industry analysts expect sales growth to slow in 2023. Comparing 2023 to 2022, Technomic projects nominal sales growth of 5.5%, which translates to 1.5% real growth. Datassential is assuming a higher inflation rate, so while it predicts nominal growth of 7.6%, it projects a .1% decline in real growth from 2022 to 2023. The NPD Group expects about a percentage point growth in customer traffic.

While employee turnover has eased some from its peak in winter 2022, expect labor challenges to continue in 2023, says Fernandez. About 60% of limited-service employees have been at their job for less than six months, according to Black Box Intelligence. Operators “need to quickly get [employees] onboarded, trained and ready to work,” notes Fernandez.

For 2023 perspectives from operators including Smashburger, Capriotti’s Sandwich Shop and Wing Zone, and Purdue University, click here.

OFF-PREMISE OPPORTUNITIES

Off-premise dining continued to deliver sales in 2022, accounting for 70% of restaurant traffic, according to the National Restaurant Association. “The industry is forever more going to be a little more off-premises oriented, a little more digitally driven,” says NPD’s Portalatin. Expect restaurant designs that facilitate off-premise occasions, he says. Think multiple drive-thru lanes and interior designs that ease pickup. Henkes notes that some full-service restaurants, like Famous Dave’s, are branching out with quick-service drive-thru locations.

In March 2022, Famous Dave’s opened a drive-thru location in South Salt Lake, Utah. Courtesy of Famous Dave’s.

“Given the bigger share of the pie that off-premises has, there are a lot of incentives for restaurants to get better in the future.”

—Victor Fernandez, Black Box Intelligence

Consumers crave off-premise dining, but in some cases rate the experience significantly lower in online reviews, reports Black Box Intelligence. Looking at full-service restaurant reviews, off-premise experiences receive 2.7 stars, on average, compared with 3.7 stars on-premise. “There are more complaints about wait times, cold food and inaccuracy,” Fernandez reports. “Given the bigger share of the pie that off-premises has, there are a lot of incentives for restaurants to get better in the future,” he says. Savvy operators might invest in technology that fosters a seamless process, equipment that speeds up service and holds orders warm, improved packaging and menu design that focuses on items that travel well.

SHIFTING POPULATIONS

Even with pandemic restrictions lifted, the majority of “office workers” in many locales still work from home. “Looking at the return to office, the levels that are the lowest tend to be the communities that historically have had the longest commuting times,” says Riehle. For example, New York and D.C. offices are at 44% occupancy, according to a National Restaurant Association analysis of Kastle Systems data.

In response, some foodservice operations are moving to suburban/rural areas to better capture sales. “The operator community is being extremely innovative and relentless in adapting to this new playing field,” says Riehle.

TECHNO-TRENDS

“Technology is increasingly a differentiator between the winners and losers,” says Golladay, noting that the pandemic and the labor crunch accelerated the adoption of many consumer-facing technologies, like apps and kiosks. These investments could offer businesses a competitive edge in 2023, as consumers watch their wallets more. Portalatin notes that the industry handled 2.1 billion digital orders in summer 2022, more than twice the amount in summer 2019.

To increase efficiency, some chains are turning to AI systems that predict consumer demand, Riehle says. This information can reduce costly food waste, speed up service and improve employee scheduling.

In May 2022, Wing Zone signed an agreement to make a robot at its fry station standard in all future traditional restaurant builds. Courtesy of Miso Robotics.

Given the labor shortage and rising wages, some chains are testing robotics to fry chicken wings, flip burgers and perform other tasks. But don’t expect robots to take over the industry anytime soon. Even McDonald’s doesn’t foresee sufficient ROI. “The economics don’t pencil out,” said CEO Chris Kempczinski, in a July earnings call, noting that “it’s not practical in the vast majority of restaurants.”

RELATED CONTENT

- Advertisement -

- Advertisement -

- Advertisement -

TRENDING NOW

- Advertisement -

- Advertisement -

- Advertisement -