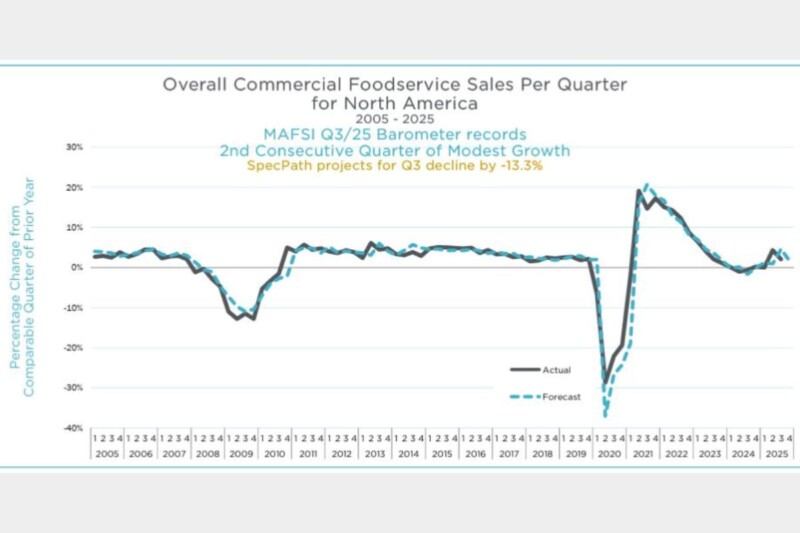

Following Negative Results, Reps Predict Better Year Ahead

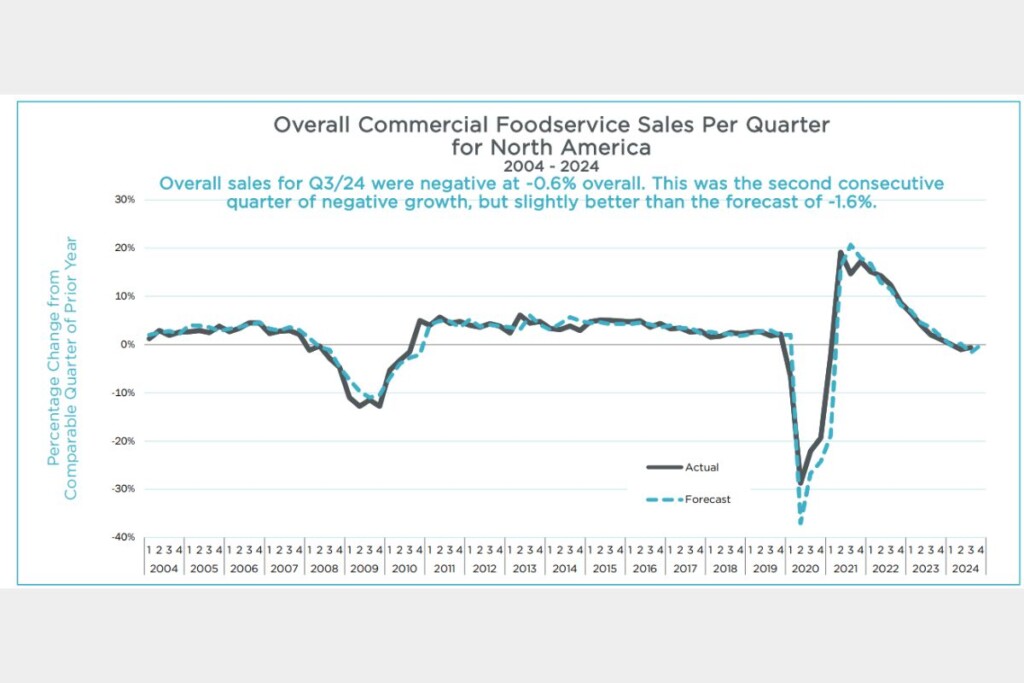

The third quarter of 2024 was the second consecutive quarter of negative growth.

At -0.6%, Q3/24’s overall sales exceeded expectations by 1%, but still marked the 13th consecutive quarter of shrinking industry sales, according to the Q3/24 MAFSI Business Barometer.

The report, published Dec. 5, notes all four product categories saw negative results, with equipment down -0.1%, supply at -2.3%, tabletop at -1.6% and furniture at -3.1%. Overall sales varied by region, with totals as follows: +2.2% in the West, +0.9% Midwest, -1.1% in Canada, -2.7% in the Northeast and -3.3% in the South.

This comes after a Q2 in which MAFSI recorded a -1.0% decline in overall sales.

In Q4/24, MAFSI is anticipating zero growth, backpedaling on an earlier expectation for a second-half rebound.

“Likely the industry will adapt to the ‘new normal’ with improved results in 2025,” writes Michael R. Posternak, CEO of PBAC and Associates, in his executive summary. “We are about to enter the fourth leg of the elongated ‘W’ shaped curve of the COVID era: first was the shutdown plunge, second the reopening surge, third the slow decline towards normalization and next the upward return to slow-to-moderate growth.”

In 2025, MAFSI reps forecast a “modest recovery” at +2.7%—led by supplies at 3.0%, followed by equipment at 2.8%, tabletop at 2.5% and furniture at 1.3%.

RELATED CONTENT

- Advertisement -

- Advertisement -

- Advertisement -

TRENDING NOW

- Advertisement -

- Advertisement -

- Advertisement -