MAFSI Barometer: Sales Continue To Improve

By product, tabletop sales rose the most at 4%, and by region, the Northeast saw the biggest gain (5.3%).

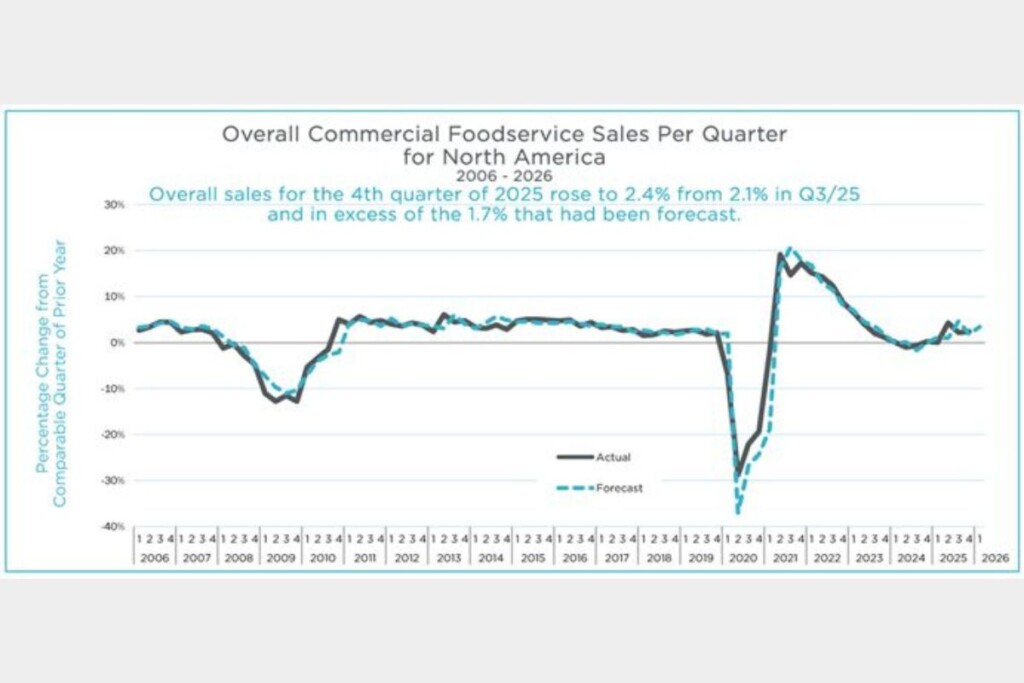

Overall sales for Q4/25 rose to 2.4% from 2.1% in Q3/25, and in excess of the 1.7% that was forecasted, according to the MAFSI Business Barometer, a nonfood sales/trend indicator for the foodservice industry. Q4/25 marked the third consecutive quarter of modest improvement.

By product category, Q4/25 sales compared to Q4/24 were the following: tabletop, 4%; supply, 3%; equipment, 2.1%; and furniture, 1.9%.

By region, Q4/25 sales compared to Q4/24 were the following: Northeast, 5.3%; West, 4.6%; South, 2.8%; Canada, 1.6%; and Midwest, 0.8%.

Looking at MAFSI’s SpecPath, the number of specified projects declined from 3,718 in 2024 to 3,444 in 2025, a decrease of -7.4%.

The Q1/26 sales forecast is for a further increase to 3.5% and for 2026, a gain of 4.3%.

Click here to view the full Q4/25 MAFSI Business Barometer report.

RELATED CONTENT

- Advertisement -

- Advertisement -

- Advertisement -

TRENDING NOW

- Advertisement -

- Advertisement -

- Advertisement -